Investment Approach

Founded in 1983 to manage portfolios for high net-worth individuals and institutions, we have evolved to offer a variety of strategies in different investment vehicles. But, we remain consistent in our investment approach in everything we do.

Our Philosophy

Every portfolio we manage is invested with a price discipline and for the long term.

1

Invest With A Price Discipline

2

Invest For The Long Term

Time and Time Again

In his many years working in the investment management industry, Jim Cullen has experienced numerous market cycles, which have all suggested that value investing works when consistently applied. The wisdom he has gained from this experience always reminds our investment team that in light of what the news and pundits might otherwise suggest, this time is not necessarily “different.”

Invest with discipline, for the long-term

Legendary investor, Benjamin Graham, said it best in summarizing his 50 years in the investment business. He said that the key to being successful in investing was to ignore everything else and focus on two fundamental principles:

- Invest with a discipline that helps you to avoid overpaying for your investments. The disciplines he recommended were price/earnings, price/book and dividend yield

- Be a long-term investor (i.e. 5 years).

Along with our strategies incorporating these principles, our historical studies and experience suggest that both compounded annualized returns and rolling 5-year returns benefit from investing in low price/earnings, low price/book, and high dividend-yielding stocks.

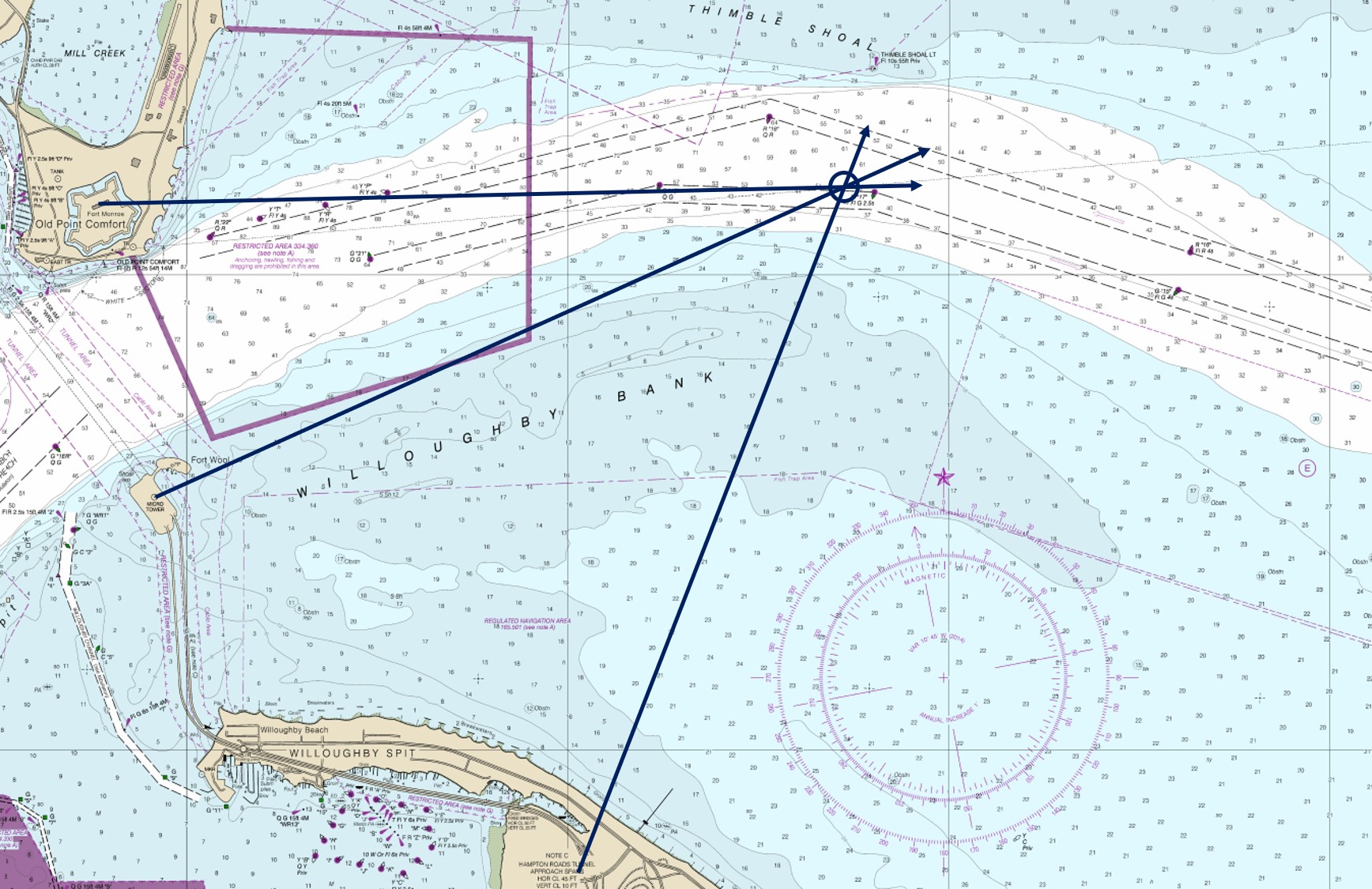

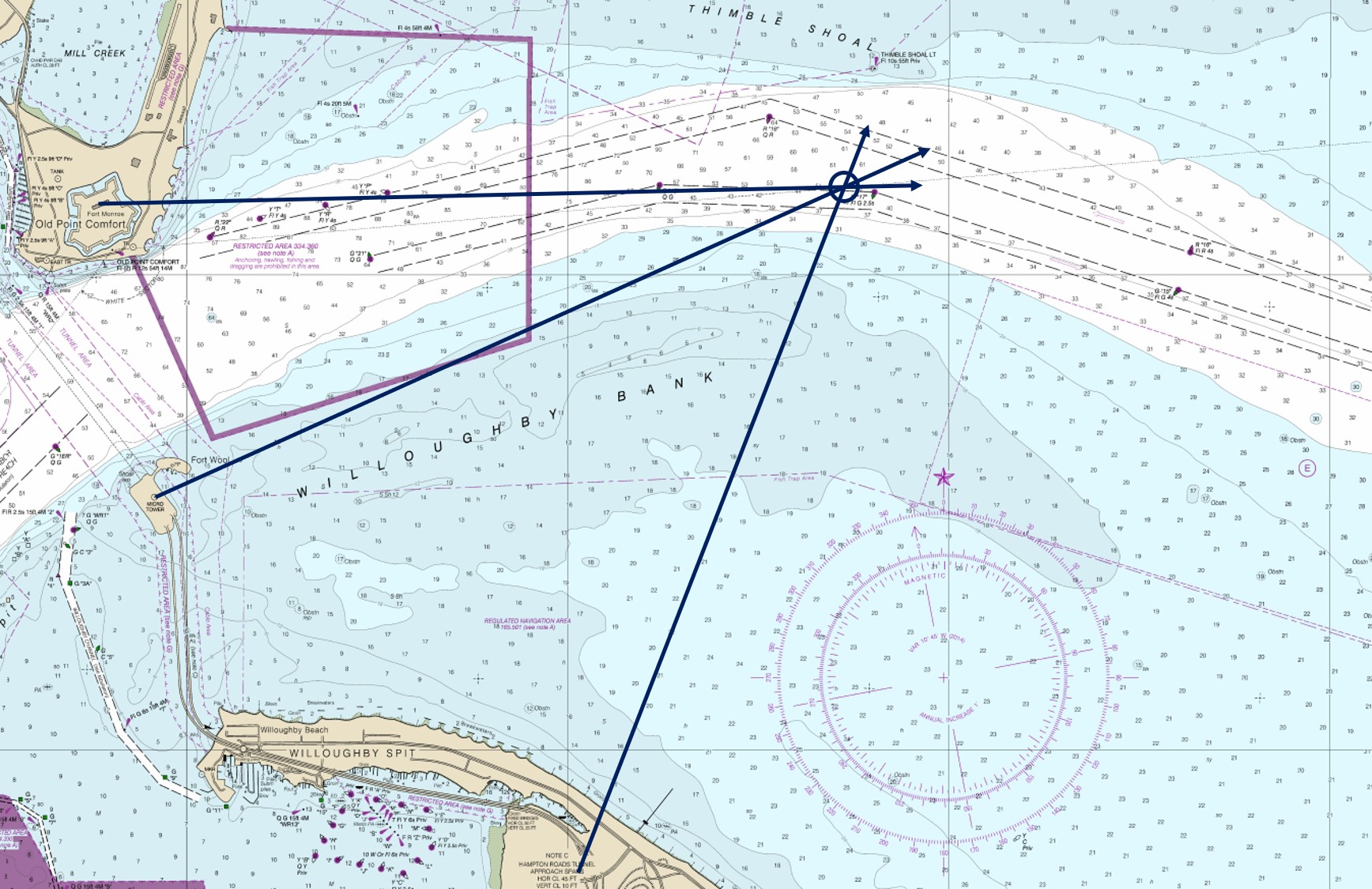

Cullen attributes to some of his most successful trades his three-point fix framework for evaluating stocks

Investors always have a lot of things to worry about, but are rewarded if they are disciplined enough to stay the course.

Jennifer Chang

Portfolio Manager, Executive Director

Investors always have a lot of things to worry about, but are rewarded if they are disciplined enough to stay the course.

Jennifer Chang

Portfolio Manager, Executive Director

Cullen attributes to some of his most successful trades his three-point fix framework for evaluating stocks